Introduction:

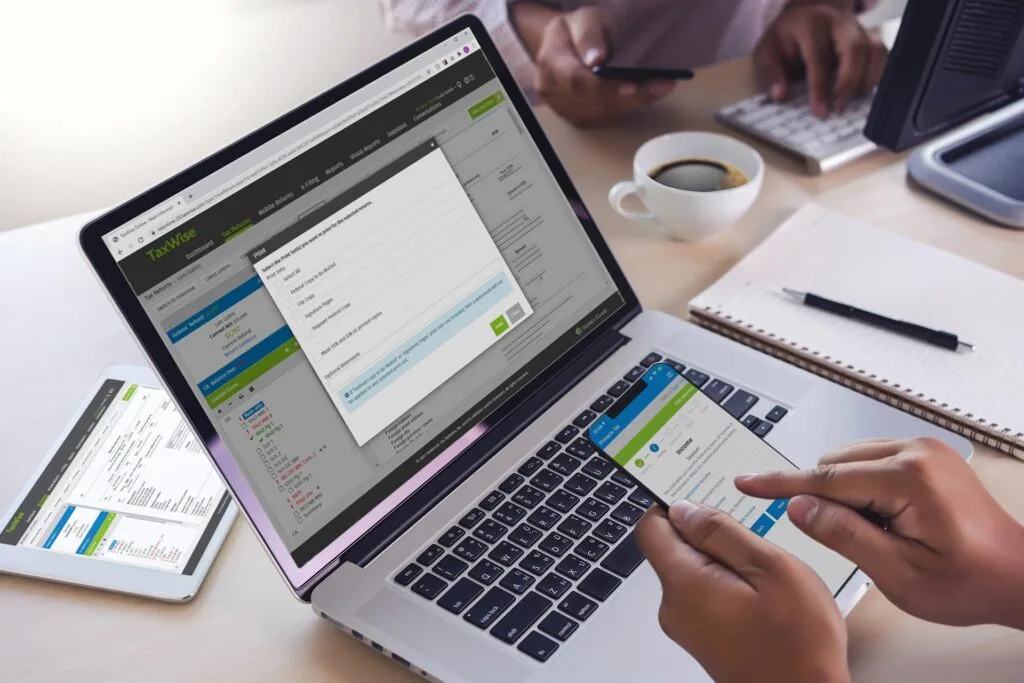

In today’s dynamic and competitive business landscape, companies are constantly seeking ways to optimize their operations, reduce costs, and maximize efficiency. One crucial aspect that often consumes significant time and resources is accounting.

As businesses strive to focus on their core competencies and strategic initiatives, many are turning to outsourced accounting services as a valuable solution. In this blog, we will explore the importance of outsourcing accounting services and the numerous benefits it brings to businesses.

Access to Expertise and Specialized Knowledge:

Accounting is a specialized field that demands in-depth knowledge, expertise, and adherence to complex regulatory frameworks. By outsourcing accounting services, businesses gain access to a team of highly skilled professionals with specialized knowledge in accounting principles, tax regulations, and industry-specific financial practices.

These experts possess the qualifications and experience necessary to ensure accurate financial reporting, compliance, and timely completion of essential tasks such as bookkeeping, tax preparation, and financial analysis. Leveraging their expertise, businesses can confidently navigate complex financial landscapes, optimize tax strategies, and make informed decisions based on reliable financial data.

Outsourcing accounting services enables businesses to tap into a pool of talent with diverse skill sets and industry experience. Whether it’s managing international accounting standards, addressing industry-specific challenges, or staying updated on the latest tax regulations, outsourced accounting professionals bring a wealth of knowledge to the table. This access to specialized expertise ensures that businesses receive accurate and up-to-date financial insights, enabling them to make informed decisions that drive growth and profitability.

Cost Savings and Efficiency:

Managing an in-house accounting department can be a significant financial burden. By outsourcing accounting services, businesses can substantially reduce costs associated with hiring, training, and retaining full-time accounting staff. Additionally, outsourcing eliminates the need for costly investments in accounting software, technology infrastructure, and office space.

Outsourced accounting service providers offer flexible pricing models, allowing businesses to pay for services based on their specific needs, thereby optimizing cost-efficiency. Moreover, these service providers employ streamlined processes, automation, and advanced accounting tools, resulting in faster and more accurate financial management. By leveraging the expertise and operational efficiency of outsourced accounting services, businesses can allocate resources strategically, ultimately driving growth and profitability.

Furthermore, outsourced accounting services enable businesses to benefit from operational efficiency. These service providers leverage advanced accounting software, automation tools, and streamlined processes to expedite financial tasks such as invoice processing, expense management, and financial reporting. By utilizing these technologies and efficient workflows, outsourced accounting professionals can handle financial operations swiftly and accurately. This not only saves time but also minimizes the risk of errors or delays, ensuring that financial information is available when needed.

Focus on Core Business Functions:

Outsourcing accounting services enables businesses to shift their focus from mundane and time-consuming accounting tasks to their core business functions. By delegating accounting responsibilities to external experts, business owners and management can dedicate their energy and resources to strategic initiatives, product development, market expansion, and customer engagement.

This strategic redirection allows businesses to enhance productivity, improve operational effectiveness, and gain a competitive edge in the market. Outsourcing accounting services ensures that financial management remains in capable hands, providing peace of mind and freeing up valuable time for strategic decision-making and driving business growth.

Moreover, outsourcing accounting services ensures that financial management remains in capable hands. These professionals handle critical financial tasks, such as maintaining accurate records, managing cash flow, and preparing financial statements, with precision and attention to detail. Business owners can have peace of mind knowing that their financial affairs are being managed by qualified professionals, allowing them to focus on driving business growth and achieving strategic goals.

Enhanced Data Security and Confidentiality:

Accounting involves handling sensitive financial information, including payroll details, client data, and proprietary financial statements. Outsourced accounting service providers prioritize data security and confidentiality as paramount concerns. They implement robust data protection protocols, adhere to stringent regulatory requirements, and employ state-of-the-art cybersecurity measures to safeguard confidential information.

By outsourcing accounting services with BKCPROHUB, businesses can benefit from advanced data security systems, reducing the risk of data breaches, unauthorized access, or other security threats. This enhanced data security instills trust among stakeholders, protects the company’s reputation, and mitigates potential legal and financial liabilities associated with data breaches.

Conclusion:

Outsourcing accounting services has become a strategic choice for businesses seeking to optimize their financial management processes. It provides access to expertise, reduces costs, enhances efficiency, and allows businesses to focus on their core functions. Furthermore, outsourcing ensures data security and confidentiality, critical aspects in today’s digital age. By partnering with a trusted accounting service provider, businesses can unlock growth opportunities, streamline operations, and achieve long-term success.

Remember, outsourcing accounting services is not a one-size-fits-all solution. Businesses should carefully evaluate their specific needs, consider their industry requirements, and choose a reputable and experienced accounting service provider to maximize the benefits.

BKCProHub is proud to provide exemplary startup professional virtual CFO services that constitute a firm foundation for successful startups. However, it involves more than mere financial management but a comprehensive partnership between financial and futuristic skills. As a specialist with profound knowledge of the complex financial problems of startups, our CFO accounting services are precisely designed to promote long-term success by offering customised and efficient professional assistance without the founders having to afford a full-fledged CFO.

Thus, our team will not only act in the role of financial watchdogs but also as strategic friends knowledgeable of the intricacies of the competitive terrain. Your startup transforms into a powerhouse by adopting our specially tailored Virtual CFO Services. BKCProHub – where collaboration equals excellence in developing a trajectory of your specific business goals.

Role Of CFO In Your Business

As a small business owner, managing finances can be a daunting task. This is where CFO services and accounting services can come in handy. CFO services involve hiring a Chief Financial Officer (CFO) who can manage your company’s finances and provide strategic financial guidance. Accounting services, on the other hand, can provide support with bookkeeping, tax preparation, and financial reporting.

A CFO can help you make informed decisions by analyzing financial data and creating budgets and forecasts. They can also help you raise capital and manage cash flow, as well as identify opportunities for growth and cost savings. With a CFO’s expertise, you can gain a better understanding of your business’s financial health and plan for the future.

Accounting services can provide crucial support for small businesses by managing day-to-day financial tasks such as invoicing, accounts payable and receivable, and payroll processing. They can also help ensure that your business is compliant with tax laws and regulations, and can prepare financial statements and reports for stakeholders.

If you’re looking for the best possible contact for CFO services or accounting services, consider working with a reputable firm that specializes in small business accounting. Look for a firm that has experience working with businesses similar to yours, and that offers customized solutions tailored to your specific needs.

One great option for small business accounting is to work with a virtual CFO or accounting service provider. This allows you to access expert financial guidance and support without the overhead costs of hiring a full-time CFO or accounting staff. Plus, virtual providers can often offer more flexible pricing and customized packages based on your specific needs.

When choosing a CFO for your small business accounting, make sure to do your research and choose a partner that you feel comfortable working with. Look for a provider that is responsive, proactive, and has a track record of success working with businesses like yours. With the right financial partner, you can take your business to the next level and achieve long-term success.