Introduction:

Small and medium-sized businesses (SMEs) sometimes experience difficulty in properly managing their financial operations while concentrating on their main company functions in the modern business atmosphere. Virtual Chief Financial Officer (CFO) services can help in this situation. SMEs can adopt smart choices and get financial stability through virtual CFO services, which give them access to the knowledge and leadership of expert financial professionals. This blog post will explain what virtual CFO services are and why they are a growingly popular corporate solution.

What is a Virtual CFO?

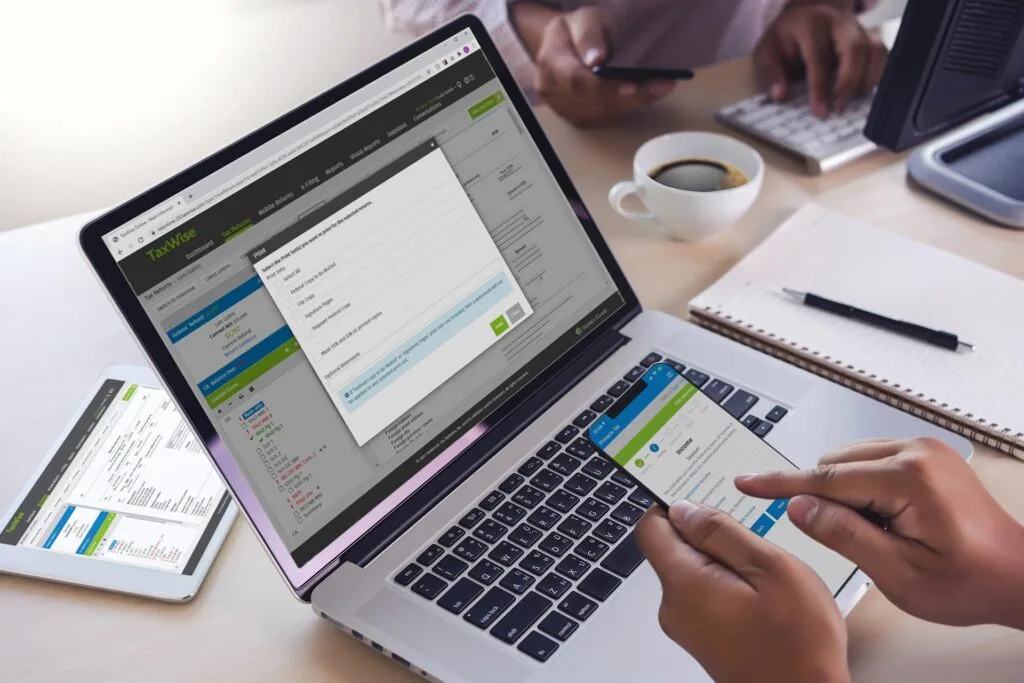

The term “virtual CFO services” describes remote outsourcing of financial management and strategic advice. Instead of working on-site like traditional CFOs, virtual CFOs utilize cloud-based technology to work remotely, enabling them to serve organizations from anywhere in the world. These experts offer comprehensive financial advice to clients and have an in-depth knowledge of accounting and finance concepts. Businesses can receive top-notch financial services by taking advantage of their expertise without having to hire a full-time internal CFO.

What’s Included in Virtual CFO Services?

1. Risk Management and Compliance:

Any firm must manage risks and comply with financial requirements. Assessing and reducing financial risks, ensuring compliance with regulations, and putting in place strong internal controls are all part of the virtual CFO. Virtual CFOs assist companies in creating efficient risk management plans and keep them informed of new rules. This proactive strategy helps reduce the likelihood of non-compliance, fines, and reputational harm, thereby protecting the company’s interests.

Diversification of revenue sources, insurance, financial hedging, and planning for emergencies are a few examples of these practices. They support companies by utilizing a proactive approach to risk management that enables them to anticipate potential risks and successfully handle difficult situations.

2. Financial Planning and Analysis:

One of the core components of virtual CFO is financial planning and analysis. Virtual CFOs develop financial forecasts, budgets, and cash flow projections to help businesses understand their financial position and make informed decisions. They analyze historical data and industry trends to provide valuable insights that aid in strategic planning and growth initiatives. By implementing financial models and key performance indicators (KPIs), virtual CFOs enable businesses to monitor their financial health and identify areas for improvement.

Why Is It A Growing Trend?

1.Strategic Financial Advisory:

Virtual CFOs play an important role in giving firms strategic financial guidance. They engage closely with company owners and management groups to set financial goals, create growth plans, and evaluate investment possibilities. Virtual CFOs help business owners make decisions compatible with their long-term goals by performing financial analysis and planning for future situations. Businesses are able to solve complex financial problems and increase profitability by using their knowledge of capital structure, acquisitions, and mergers, and restructuring their finances.

2. Cost Optimization and Efficiency:

Effective cost management is necessary for the survival and expansion of businesses. Virtual CFOs find ways to cut costs, maximize spending, and simplify financial procedures. To ensure firms get the best deal possible, they examine costs, negotiate vendor agreements, and examine pricing schemes. Virtual CFOs help with improving the overall financial performance of the company by identifying errors and putting cost-cutting measures into place. Assessing and reducing financial risks is one of the main duties of virtual CFOs. They thoroughly examine the financial environment of the company, finding potential risks and weaknesses.

Conclusion:

In the current digital era, virtual CFO is growing as a powerful choice for businesses searching for the best financial expertise without the cost of a full-time CFO. From financial planning and analysis to risk management and strategic guidance, virtual CFOs provide a wide range of services that are customized to each company’s specific needs.

By relying on their experience, businesses may overcome obstacles, develop sustainable growth, and make smart financial decisions. In order to give SMEs an advantage in competition. As the business environment evolves virtual CFO are anticipated to become more popular.

Think about utilizing the virtual CFO given by trustworthy partners like BKCProHub to stay ahead in the competitive marketplace of today. For organizations, incorporating virtual CFO services can be a game-changer, allowing them to focus on their core capabilities while outsourcing accounting duties to professionals.