In the USA, states have powers to recognize the incorporation of the business in the case of Intracompany sales. If the sales or the provision of services are intercompany then the federal has the jurisdictional right to tax the business structures and make it compliant.

Based on this rule of the land, most of the states of the USA make it compulsory to incorporate the Company in the state as a foreign company/LLC.

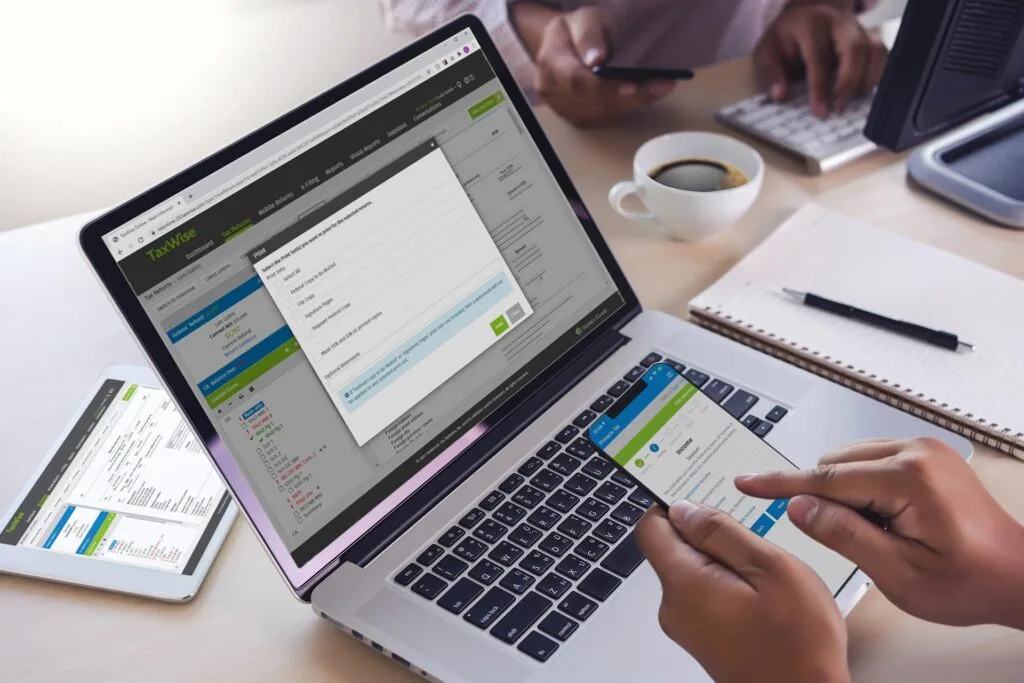

In recent times, most of the LLCs/Corporations would like to do business in the whole US but it creates challenges in terms of compliance and taxes as well. Here I just tried to explain the complicated things in an easy manner.

The first step in the online Business Registration process is to choose a Legal Business Entity that will define its Business structure and Business process with which it will conduct and Run Their Business activity.

When any business wants to sell to the states where they are not incorporated then there are two options to make sales: